Introduction

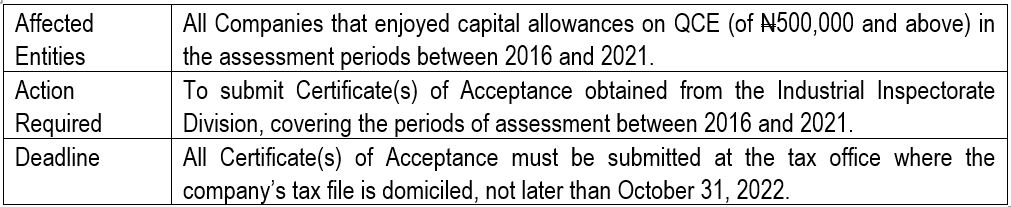

Recently, the Federal Inland Revenue Service (“FIRS”) issued a public notice, titled “Submission of Certificate of Acceptance” (the “Public Notice”), notifying the general public of the requirement for taxpayers incurring qualifying capital expenditure in the sum of N500,000 (Five Hundred Thousand Naira) and above, to file a Certificate(s) of Acceptance obtained from the Industrial Inspectorate Division of the Federal Ministry of Industries, Trade and Investment (“Industrial Inspectorate Division”) with the FIRS. The Certificate of Acceptance required by the FIRS is expected to cover all capital allowances enjoyed by such taxpayers, in the assessment periods between year 2016 and 2021.

Qualifying Capital Expenditure and Capital Allowances

Qualifying capital expenditure entails expenditure incurred in a certain basis period and assessed as capital allowance granted to companies when estimating their taxable profits. Paragraph 1(1) of the Second Schedule to the Companies Income Tax Act (as amended) (“CITA”), specifies the different forms of capital that may fall under the qualifying expenditure capital allowance category, and they include:

- capital expenditure deployed for plant, machinery or fixtures;

- capital expenditure incurred in the construction of buildings, structures or works of a permanent structure;

- capital expenditure incurred in connection with, or in preparation for, the working of a mine, oil well or other source of mineral deposits of a wasting nature; and

- capital expenditure incurred on the development or acquisition of software or other such capital outlays on electronic applications, amongst other things.

The Industrial Inspectorate Division is empowered by the Industrial Inspectorate Act to assess and investigate any proposed, new, and existing undertaking involving any proposed capital expenditure; for the purpose of determining the investment valuation of the undertaking. Investigation by the Industrial Inspectorate Division usually covers determination of the actual capital (whether foreign or local) utilised in the undertaking, and the actual valuation of buildings, plants and other machinery utilised or proposed to be used in the undertaking.[1]

The Certificate of Acceptance is the instrument issued, by the Director of the Industrial Inspectorate Division,[2] to companies, showing the investment valuation of expenditure made by such companies, in connection with any of the allowable capital allowances recognised under the CITA. The Certificate of Acceptance is to be considered, by the FIRS, as definitive evidence, in its computation of assessable profit.[3]

Compliance Requirements on Qualifying Capital Expenditure (QCE) from the FIRS

Commentary

Under Nigerian tax laws, there are several capital allowances recognized in lieu of depreciation; and those allowances and deductions are taken into consideration in the determination of the taxable profits of a company. One of such allowable deductions is the qualifying capital expenditure which may cover items expended by a company involved in activities like building of structures, mining, and even technological solutions, amongst others, as provided for in the Second Schedule to the CITA.

Therefore, when a company relies on its acquisition of assets as part of its business processes for generating profits, the law allows deduction of the capital used in acquiring such assets from the company’s chargeable profits, for the relevant assessment year. The requirement for the Certificate of Acceptance obtained from the Industrial Inspectorate Division, helps the FIRS in ascertaining the actual valuation of the capital investment the company is entitled to enjoy. Ultimately, this process reduces the need for the FIRS to embark on another evaluation exercise in respect of such applicable capital assets, as the law mandates the FIRS to accept the facts stated on the face of the Certificate of Acceptance. In addition, this process reduces the likelihood of dispute between the FIRS and affected tax-paying entities on the valuation of capital allowances that may be enjoyed under the CITA.

Whereas the directives contained in the Public Notice, requiring companies to file the required Certificate(s) of Acceptance, is likely aimed at doing a due diligence check on capital allowances enjoyed by qualified companies, there are concerns around the possibility of compliance by affected entities within the stated timeline. Requests for issuance of Certificate(s) of Acceptance are expected to rise significantly, following the Public Notice and, unless a special process is put in place to ease and expedite the (otherwise typically protracted) process for issuance of Certificates of Acceptance, there is a possibility that some affected companies may be unable to meet the October 31, 2022, submission deadline imposed by FIRS.[4] Considering that the consequence for non-compliance with the said directives, is that the FIRS may withdraw or disregard capital allowances granted for the relevant years of assessment (2016 to 2021) for affected companies, it will be helpful if the – (1) process for application for, and issuance of, Certificates of Acceptance is improved upon and made seamlessly and timely; and/or (2) compliance timeline is extended to aid satisfactory compliance.

The Grey Matter Concept is an initiative of the law firm, Banwo & Ighodalo.

DISCLAIMER: This article is only intended to provide general information on the subject matter and does not by itself create a client/attorney relationship between readers and our Law Firm or serve as legal advice. We are available to provide specialist legal advice on the readers’ specific circumstances when they arise.

[1] Section 2(1), Industrial Inspectorate Act, 2004, as amended.

[2] Section 3(3), Industrial Inspectorate Act, 2004, as amended.

[3] Section 5(1)(a), Industrial Inspectorate Act, 2004, as amended.

[4] The process for obtaining a Certificate of Acceptance may often take between 3 months and 1 year.